Unlocking the Power of MFI Index: Price Insights and Strategies

The MFI, or MFI, is an important thing in trading. It helps traders figure out how strong a price fluctuations are. The MFI monitors how much money is coming coming and going of a stock over a time period. It gives you some really valuable information about how the market condition.

Market Cap, often abbreviated as market cap, is an indication of the overall worth of a company's existing shares. It is determined by multiplying the present market value per share by the entire stock amount traded on the market.

Determining a company's market capitalization is extremely important for stock investors and traders. It shows you how big and how promising the company is. A larger market capitalization usually indicates the company is bigger and more well-known. On the other hand, a lower market capitalization might mean the company is newer and less known.

Volume refers to just the quantity of shares or contracts bought and sold in a specific period. It's a major consideration in technical analysis because it shows you the extent of interest from people are interested in the stock and its rapidity of movement.

High trading volume means lots of people are interested in the stock, which can mean significant price changes. But if Volume refers to low, the stock might see limited movement, or it may be difficult to predict its direction.

The RSI is a tool that shows you how fast price movement direction. It goes from 0 to 100 and is used to determine if the stock is overvalued (overbought) or undervalued (oversold).

When the RSI exceeds 70, the stock could be overvalued. If it falls below 30, it could be a favorable buy. Traders often utilize the RSI with additional indicators, like the MFI, to obtain a clearer view of what's happening in the market.

Support and Resistance price marks constitute significant concepts in technical analysis. Support is where the stock may stabilize its decline, and resistance is where the stock may halt its increase.

Traders look at these price thresholds, based on historical price behavior, to determine potential buy or sell points. Examining the MFI with these price thresholds may assist traders determine how robust or fragile a stock could be.

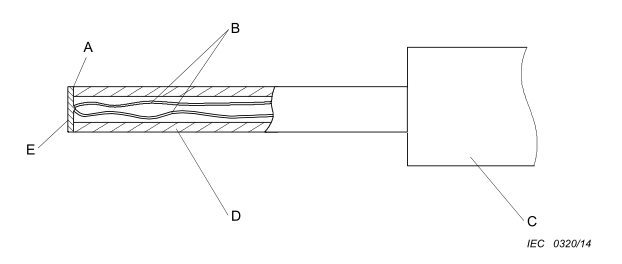

- ISO 80369-7 Luer Connector Gauge with 6% Tape

- KINGPO will meet you at the 92nd China International Medical Equipment (Autumn) Expo in 2025

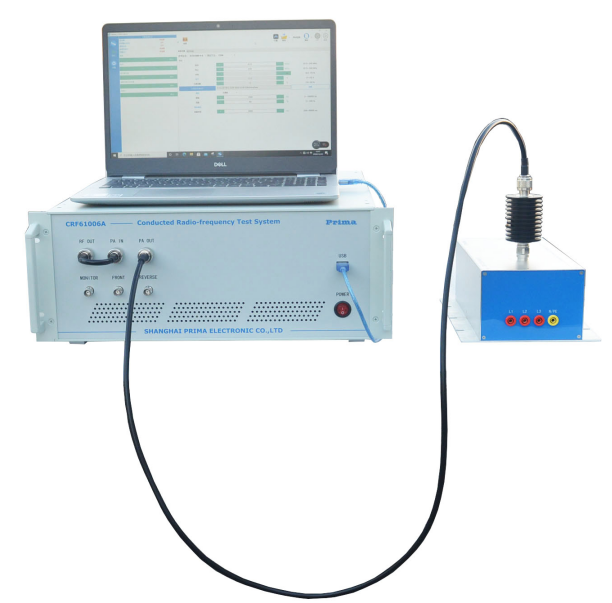

- Fatal mistakes in IPX9K waterproof test: nozzle size and water temperature control, the truth you must know

- What are the key differences between ISO 80369-7 and ISO 594?

- ISO 80369-7 Luer Gauge Checklist

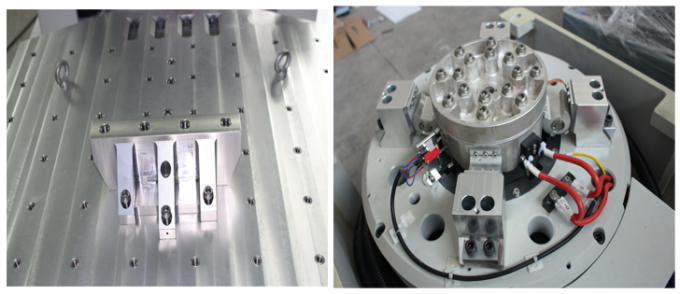

- KINGPO 2024 R&D Results Report

- ISO 594 is replaced with ISO 80369

- ISO 80369-7:2016 Connectors with 6% (Luer) taper for intravascular or hypodermic applications What is the ISO 80369-7 standard? What happened to ISO 594-1 and ISO 594-2?

- Understanding the Importance of Buying a Luer Connection Test Kit

- Understanding ASTM F2059 Fluid Flow Test: A Comprehensive Overview